Fund Report May 2023 - Tycoon Global Growth Equity Fund

Tycoon Global Growth Fund Monthly Report - May 2023

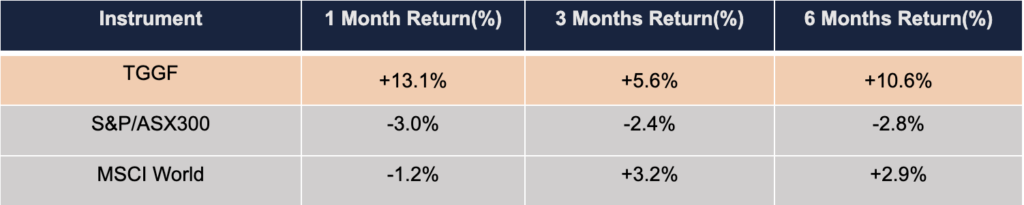

Fund Performance

The Tycoon Global Growth Fund achieved an impressive monthly return of 13.1% in May 2023, marking the largest single-month increase since July 2022, with a return of 30.3% since the beginning of 2023. This performance far exceeds the returns of the MSCI World Index and the Australian S&P/ASX300 Index. It’s worth mentioning that our early and proactive positions in Tesla, Nvidia, and other AI, chip, and new energy companies have performed well, highlighting our excellent ability in stock selection and understanding industry trends.

Market Review

In May 2023, global stock markets showed mixed trends. At the end of the month, the US debt ceiling crisis was averted through consensus between the Democratic and Republican parties, slightly boosting market confidence. Meanwhile, due to the boom in AI-related chip companies triggered by ChatGPT, the market anticipates that the AI revolution will have a significant impact on global productivity. AI technology will automate repetitive tasks, provide intelligent decision support, and accelerate innovation, thereby saving human time and resources and boosting production efficiency. Driven by this trend, the Nasdaq Composite Index rose by 5.8%, the Dow Jones Industrial Average rose by 0.2%, while the global stock market index MSCI World Index fell by 1.2%, and the Australian S&P/ASX300 Index fell by 3.0%. However, inflation is expected to persist at high levels, and the tightening of financial conditions will impact global economic activity, slowing future global economic growth. Against this backdrop, the market has started to focus on industries that will have a profound impact on the future, such as the new energy and technology sectors, and the importance of a company’s performance in ESG (Environmental, Social, and Corporate Governance) has been further elevated. In addition, the financial condition of companies has become an important consideration for the current market.

Macroeconomic Outlook

The non-farm data for the United States in May far exceeded market expectations, with the addition of 390,000 non-farm jobs, surpassing the projected 325,000. The average number of jobs over the past three months is 420,000. The unemployment rate is 3.6%. This shows that the US job market still demonstrates strong resilience, with the number of new jobs remaining high, and the gap of 820,000 to return to pre-pandemic full employment levels will quickly narrow. The labor participation rate has slightly rebounded, wage growth rate is flat compared to last month, but continues to decline year-on-year, indicating that current wage growth has slowed. The better-than-expected non-farm data significantly increased the probability of the Federal Reserve raising interest rates in June, and Wall Street generally believes that the Federal Reserve will continue to raise interest rates by 25 basis points in June. In addition, the market has started to worry about the impact of long-term high interest rates and persistently high levels of inflation on the economy. Although the market currently holds an optimistic attitude towards achieving a soft landing for the economy, Wall Street analysts predict that US inflation will return to near the Federal Reserve’s target level of 2% next year. However, whether the Federal Reserve can balance the goals of a soft economic landing and curbing inflation has become a major concern for global investors.

Investment Strategy

2023 is a pivotal year of transition, where the market will experience significant volatility and changes in policy, creating valuable opportunities for investors. In the midst of market turbulence, it is crucial to adhere to value investing principles and actively position oneself in companies with long-term growth prospects. Filtering out short-term market noise and focusing on the market’s long-term development direction to identify the most valuable information is essential.

High inflation and interest rates present a significant test for companies’ governance capabilities, and the market places greater emphasis on companies’ profitability and future adaptability. Environmentally friendly companies that can significantly enhance productivity are highly sought after by the market, forming a new productivity virtuous cycle. We will continue to seek out companies that represent future productivity and high quality, and as these companies grow, we aim to generate sustainable high returns for investors.

Top Five Investments(in alphabetical order)

1. IFX GY – Infineon Technologies AG is a German semiconductor solutions provider, offering a range of products including microcontrollers, LED drivers, sensors, and integrated circuits for automotive applications and power management. It currently has a market capitalization of $46.8 billion, a price-to-earnings ratio of 16.7, and earnings per share of $1.6.

2. LTHM US – Livent Corporation is a fully integrated lithium company that focuses on providing high-performance lithium compounds for the electric vehicle (EV) and broader battery markets. It currently has a market capitalization of $4.5 billion, a price-to-earnings ratio of 13.3, and earnings per share of $1.6.

3. NVDA US – NVIDIA Corporation, founded in January 1993, is a semiconductor company primarily known for designing and selling graphics processing units (GPUs). The company is expanding into markets related to artificial intelligence and computer vision and is the creator of CUDA, an important development tool for GPUs. It currently has a market capitalization of $97.1 billion, a price-to-earnings ratio of 203, and earnings per share of $1.8.

4. TSLA US – Tesla, Inc. is an American company that designs, develops, manufactures, sells, and leases electric vehicles and energy production and storage systems. It also provides related services. It currently has a market capitalization of $678 billion, a price-to-earnings ratio of 57, and earnings per share of $4.0.

5. WCH GY – Wacker Chemie AG, founded in 1914, is a global specialty chemical materials company. As a pioneer in the modern chemical field, Wacker’s products include silicones, polymers, biotech, and polysilicon. It currently has a market capitalization of $6.6 billion, a price-to-earnings ratio of 6.3, and earnings per share of $25.2.