Fund Report April 2023 - Tycoon Global Growth Equity Fund

Tycoon Global Growth Fund Monthly Report - April 2023

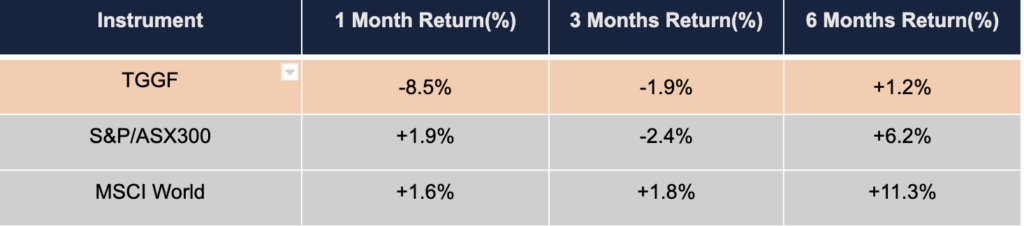

In April 2023, the Tycoon Global Growth Fund experienced a modest retracement of 8.5%, following three consecutive months of positive returns. However, since the beginning of the year, the fund has shown impressive performance, with a gain of 12.2%, surpassing the MSCI World index by 9% and the S&P/ASX300 Australia index by 5.2%. The temporary decline in April was primarily driven by major positions in Tesla, Infineon, and Enphase, but it is important to note that these stocks have exhibited strong upward momentum. Such corrections are considered healthy and provide an opportunity for continued growth in the future. With a strategic focus on investing in high-quality, future-oriented companies, we remain confident in the Tycoon Global Growth Fund’s ability to generate consistent and sustainable returns, even within the context of a volatile and uncertain macroeconomic environment.

Global equity markets displayed a modest upward movement, propelled by the resilience demonstrated by major companies amidst a challenging earnings season. This encouraging performance helped alleviate market concerns, resulting in the MSCI World Index closing up 1.6% for the month. The S&P 500 Index also concluded with a gain of 1.5%, while the Nasdaq Technology Index experienced minimal change. Additionally, Australia’s S&P/ASX300 Index recorded a notable rise of 1.9%.

Against a backdrop of persistent inflation and rising interest rates, market expectations for corporate earnings have been tempered in recent quarters. However, this adjustment provides an opportune moment for companies to surpass these revised expectations. With the likelihood of prolonged high interest rates and a potentially challenging macro environment, Wall Street is closely monitoring how companies will navigate these conditions in the upcoming quarters. The preparedness of management to operate within a higher interest rate environment is a key focus.

While investors approached mixed corporate earnings reports cautiously, the sentiment among long and short positions remained balanced, making it challenging to discern a clear trend. It is important to note that some investors harbor concerns regarding the Federal Reserve’s potential misjudgment, which could pose risks of an economic downturn and impact future corporate profitability.

Macroeconomic Outlook

In early April, the OPEC+ alliance surprised the market with a significant daily production cut, resulting in a sharp increase in oil prices. While this development had some dampening effect on the economy and contributed to inflationary pressures, various economic indicators indicate that the Federal Reserve’s tightening policy is beginning to have a positive impact on cooling down the overheated labor market. The resilience observed in the labor market has been a central focus for the Fed in their efforts to combat inflation, as labor shortages have led to rapidly rising labor costs, emerging as a key driver of price escalation. Investor’s view signs of an economic cooling with optimism, as it is anticipated to prompt the Fed to conclude its cycle of tightening monetary policy.

However, concerns have emerged on Wall Street regarding the possibility of the economy cooling too rapidly, potentially leading to a more severe recession, and dampening the value of risk assets. There is also skepticism among investors regarding the Fed’s ability to timely adjust its stance on interest rate hikes to prevent the economy from sliding into a recession. The recent release of Fed minutes highlighted the increased likelihood of a banking crisis and the potential for the economy to slip into a recession in the second half of the year. Moreover, growing apprehensions surrounding the impasse over the government’s debt ceiling further contribute to investor unease. Overall, the market currently lacks clear direction in balancing rate hikes and cuts, as well as concerns about hard and soft landings. Nonetheless, investors remain resilient and prepared to navigate the inherent volatility of the macroeconomic landscape.

Investment Strategy

Looking ahead to 2023, the factors that contributed to the bear market in 2022, such as inflation, are expected to reverse course. This brings a sense of optimism for investors, as the year is anticipated to be one of policy shifts, alternating periods of market positivity and negativity, and unprecedented opportunities. Taking a long-term perspective, strategically positioning investments in companies poised for growth and approaching the end of the bear market phase will lay a solid foundation for achieving exceptional returns in the years to come.

With the conclusion of the rate hike cycle, investor attention in 2023 shifts towards assessing corporate profitability and how companies can adapt their strategies to navigate a challenging macro environment while effectively managing costs. In this environment, only the most resilient companies will emerge, and those that remain will shine brightly in the future, rewarding steadfast investors with significant returns. Our focus remains on identifying future-oriented, high-quality companies available at reasonable prices, enabling us to hold them for the long term. By aligning with these companies, we aim to create sustainable, elevated returns for investors as we grow together with the chosen enterprises.

Top 5 Investments - Ticker Alphabetical Order

- IFX GY Infineon Germany offers a wide range of semiconductor solutions with various products such as microprocessors, LED drivers, sensors, and integrated circuits and power management chips for automotive applications.

- LTHM US is a fully integrated lithium-ion company. The company is focused on providing high performance lithium compounds for the electric vehicle (EV) and broader battery markets.

- NVDA US Founded in January 1993, Nvidia US is a fabless semiconductor company that designs and sells primarily graphics processors. The company is moving toward markets in artificial intelligence and machine vision and is the inventor of CUDA, an important development tool on graphics processors.

- TSLA US Tesla USA, designs, develops, manufactures, sells and leases electric vehicles and energy production and storage systems, and provides services related to its products.

- WCH GY Wacker Chem is a globally operating specialty chemical materials company founded in 1914. As a pioneer in the field of modern chemistry, WACKER’s products include silicones, polymers, biotechnology and polysilicon.

Related Post:

Tycoon Global Growth Equity Fund Tycoon Global Growth Fund – Monthly Update 06 – 2024 Related Post: Tycoon Global Growth Equity Fund Tycoon Global Growth …

Tycoon Global Growth Equity Fund Tycoon Global Growth Fund – Monthly Update 05 – 2024 Related Post: Tycoon Global Growth Equity Fund Tycoon Global Growth …

Tycoon Global Growth Equity Fund Tycoon Global Growth Fund – Monthly Update 04 – 2024 Related Post: Tycoon Global Growth Equity Fund Tycoon Global Growth …

Tycoon Global Growth Equity Fund Tycoon Global Growth Fund – Monthly Update 03 – 2024 Related Post: Tycoon Global Growth Equity Fund Tycoon Global Growth …

Tycoon Global Growth Equity Fund Tycoon Global Growth Fund – Monthly Update 02 – 2024 Related Post: Tycoon Global Growth Equity Fund Tycoon Global Growth …

Tycoon Global Growth Equity Fund Tycoon Global Growth Fund – Monthly Update 01 – 2024 Related Post: Tycoon Global Growth Equity Fund Tycoon Global Growth …