Fund Report June 2023 - Tycoon Global Growth Equity Fund

Tycoon Global Growth Fund Monthly Report - June 2023

Fund Performance

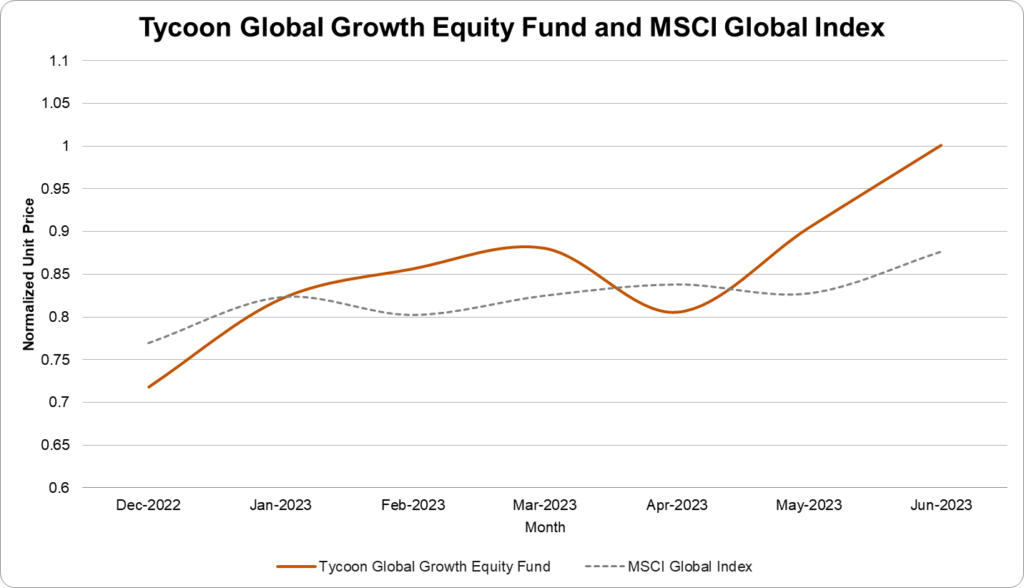

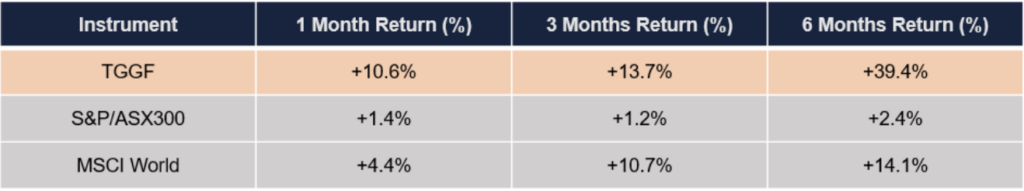

The Tycoon Global Growth Equity Fund experienced a significant increase of 10.6% in June 2023, building on its strong performance in May. This growth can be attributed to the positive allocation and early positioning of the fund towards high-quality companies, including AI-related companies such as Nvidia and Adobe. The rise in AI industry stocks since May has stimulated the overall performance of the technology sector in the market. Currently, it is widely believed that the AI revolution led by GPT will extend to various industries, and companies that are the first to adapt to AI will gain a competitive advantage in the future market.

In the first half of 2023, the Tycoon Global Growth Equity Fund achieved an astonishing return rate of 39.4%, significantly surpassing the global stock index MSCI World (14.1%) and the S&P/ASX200 index (2.4%). This has generated substantial excess returns for investors and demonstrates the exceptional investment capabilities of the Tycoon Fund.

In June, global stock markets began to steadily rise, with all three major U.S. indices experiencing gains. The S&P 500 index rose by 4.1%, the Nasdaq Composite index increased by 4.2%, and the Dow Jones Industrial Average rose by 2.5%. In Australia, the S&P/ASX 200 index saw a 0.4% increase. As global capital poured into the stock market, high-quality stocks with investment potential became extremely scarce. Amidst this investment frenzy, many companies with excellent business models, robust financial conditions, and leading market positions have been fully recognized by the market and achieved significant gains. Global investors are racing to enter the market, driven by the pursuit of high returns and growth potential, hoping to catch the last train before the bull market.

Investment Philosophy

The Tycoon Global Growth Equity Fund adopts a comprehensive and diversified investment strategy, covering Australian and international stocks. Diversified investments are strategically allocated across asset classes, countries, industries, and securities, emphasizing operational efficiency and sustainability. The fund maintains flexibility to adjust underlying assets as needed to ensure optimal performance. From a long-term investment perspective, the fund will continue to position itself in companies that make outstanding contributions to human productivity, which is expected to generate greater and more stable excess returns in the future.

Global Economic Trends

In the current macroeconomic environment, the market has already fully absorbed the anticipated two interest rate hikes, implying that investors have anticipated and adjusted to possible monetary policy adjustments. This anticipation has weakened the impact of interest rates on the market, thereby suggesting that the market may have reached a turning point. There is a high probability that the global economy will experience a soft landing, meaning that although economic growth may slow down, a sharp recession is unlikely to occur. This view is primarily based on in-depth analysis of multiple key economic indicators, including the performance of the labor market, the strength of consumer confidence, the direction of monetary policy, and global trade dynamics.

Portfolio Analysis

In the economic cycle of June, 70% of the investment portfolio companies of the Tengyun Global Growth Equity Fund exceeded expected returns. These data only cover stocks released in the recent reporting period. As the performance of most companies aligned with our expectations, the liquidity of the portfolio remains relatively stable.

Companies in the renewable energy sector continue to drive the market to new highs. Market information indicates that as of June 30, six automakers, including Volkswagen, Ford, General Motors, Rivian, Volvo, and Polestar, have announced their adoption of Tesla’s charging standard, encompassing both traditional automotive giants and emerging vehicle manufacturers. Furthermore, companies like Stellantis, Mercedes-Benz, and Hyundai are also considering or evaluating the adoption of this standard. As a result, Tesla is expanding the influence of its charging infrastructure and replacing the officially promoted Combined Charging System (CCS) in practical operation. Tesla’s NACS standard surpasses CCS in both the number of charging stations and charging speed, offering a significant competitive advantage and making it more likely to win the favor of new energy vehicle users. This news has had a positive impact on the new energy industry, with Tesla leading the way and the industry expected to continue to shine in the future.