Fund Report August 2023 - Tycoon Global Growth Equity Fund

Tycoon Global Growth Fund Monthly Report - August 2023

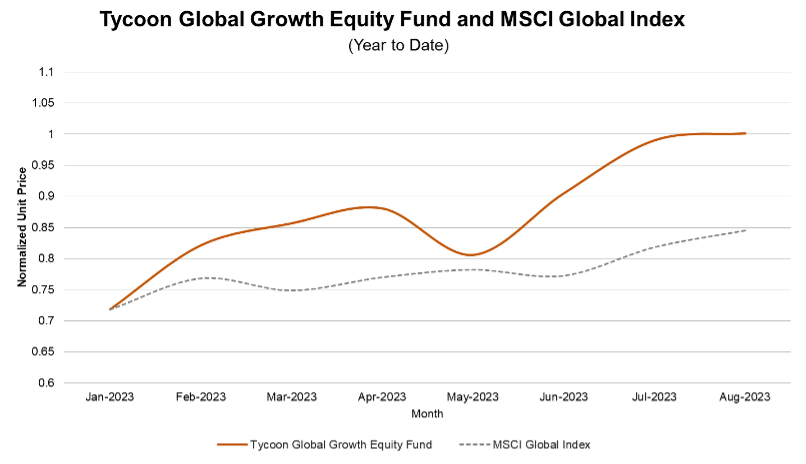

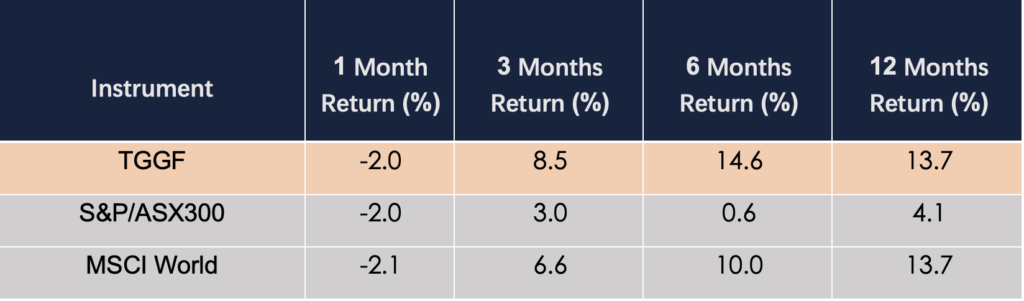

Fund Performance

Inflation remains the central focus of the market. Since March 17, 2022, the Federal Reserve has raised interest rates (i.e., the federal funds rate) 11 times, aiming to curb inflation. The current Consumer Price Index (CPI) annual growth rate is 3.2%, significantly slower than the end of the previous year. Although it is still some distance from the Federal Reserve’s 2% target, the interest rate hikes have effectively restrained inflation, which is gradually declining as expected. Affected by the cooling of the U.S. labor market, the U.S. stock market slightly adjusted this month. Influenced by this, the Tycoon Global Growth Equity Fund had a slight loss of 2% in August 2023, marking a reversal after three consecutive months of positive growth. Over the past six months, the fund has returned 14.6%, compared to the S&P/ASX 300 index’s 0.6% and the global stock index MSCI World’s 10.0%.

Global stock markets retreated in August. The S&P/ASX 300 index in Australia fell by 2.0%, the U.S. S&P 500 index fell by 1.6%, the NASDAQ index, representing tech stocks, declined by 1.6%, and the Dow Jones Industrial Average, representing traditional manufacturing, also fell by 2.0%. This market adjustment is mainly due to recent U.S. economic data showing a moderate upward trend in economic growth in August. However, such moderate growth can sometimes be misinterpreted as economic stagnation or slowdown, which may cause concerns among investors and affect market confidence.

Cybersecurity service provider CrowdStrike Holdings, Inc. (NASDAQ:CRWD) significantly contributed to the fund’s return. This month, CrowdStrike released its Q2 2023 financial report, showing an impressive 37% increase in its Annual Recurring Revenue (ARR) to 29.3 billion USD. After the release of the financial report, CrowdStrike’s stock price surged by nearly 12%. CrowdStrike’s product, Falcon, offers AI-assisted security solutions. By monitoring network traffic and data transfers in real-time, AI can detect unusual activities and take immediate action to prevent or mitigate potential security risks. Additionally, Falcon’s AI assistance can analyze vast amounts of data to identify potential threat patterns and vulnerabilities, helping enterprises strengthen their defense mechanisms.

Investment Philosophy

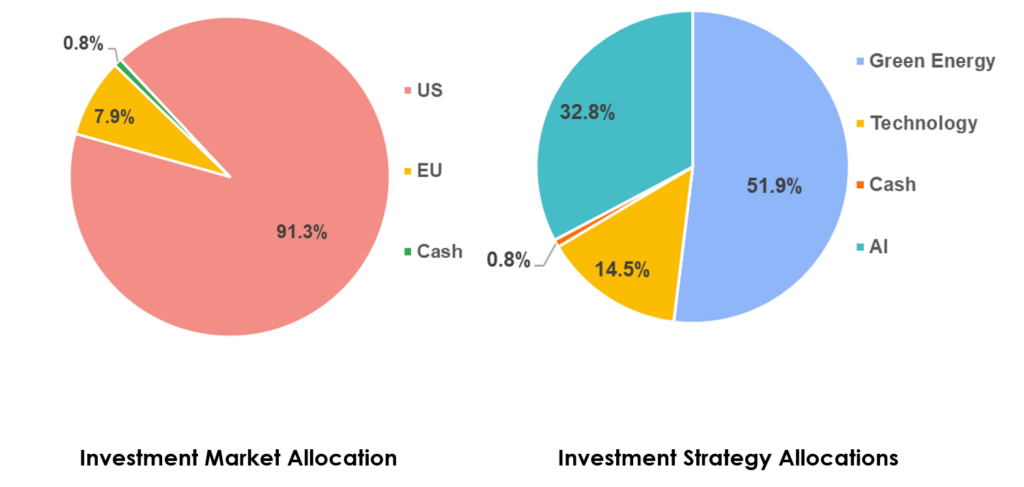

The fund focuses on identifying high-quality enterprises with future potential, believing that they will become darlings of the capital market, boosting human productivity and providing investors with long-term, consistent, and above-average returns. Moreover, the fund adopts a moderately diversified strategy, allocating stocks in developed countries and strategically investing in green energy, technology, and artificial intelligence to ensure the fund’s stability and growth potential.

Global Economic Trends

This month, the U.S. Bureau of Statistics announced an increase of 187,000 in seasonally adjusted non-farm employment in August, higher than the expected 170,000. However, the unemployment rate rose to 3.8%, higher than the expected 3.5%. These data suggest that while the employment market remains strong, there are changes in inflation persistence and labor market conditions.

Furthermore, Federal Reserve Chairman Powell emphasized the Federal Reserve’s responsibility of achieving a 2% inflation target at the Jackson Hole Global Central Bank Annual Meeting. He pointed out that inflation remains high, but economic growth is also above trend, which may be a reason for the Federal Reserve to maintain its current monetary policy. Despite the non-farm data exceeding expectations in August, the rise in the unemployment rate and revisions to previous values indicate potential changes in labor market and inflation conditions, raising market expectations for the Federal Reserve to halt rate hikes. Moreover, in July, the number of U.S. existing home sales reached 4.07 million, a low since January 2023 and below the market expectation of 4.15 million. In contrast, the total number of new home sales in July increased by 12.8% year-on-year, reaching 714,000, marking the highest in over a year. This shows that under declining inflation, U.S. consumer spending remains healthy, and the U.S. economy can achieve a soft landing towards a healthier and more stable state.

Related Post:

Tycoon Global Growth Equity Fund Tycoon Global Growth Fund – Monthly Update 06 – 2024 Related Post: Tycoon Global Growth Equity Fund Tycoon Global Growth …

Tycoon Global Growth Equity Fund Tycoon Global Growth Fund – Monthly Update 05 – 2024 Related Post: Tycoon Global Growth Equity Fund Tycoon Global Growth …

Tycoon Global Growth Equity Fund Tycoon Global Growth Fund – Monthly Update 04 – 2024 Related Post: Tycoon Global Growth Equity Fund Tycoon Global Growth …

Tycoon Global Growth Equity Fund Tycoon Global Growth Fund – Monthly Update 03 – 2024 Related Post: Tycoon Global Growth Equity Fund Tycoon Global Growth …

Tycoon Global Growth Equity Fund Tycoon Global Growth Fund – Monthly Update 02 – 2024 Related Post: Tycoon Global Growth Equity Fund Tycoon Global Growth …

Tycoon Global Growth Equity Fund Tycoon Global Growth Fund – Monthly Update 01 – 2024 Related Post: Tycoon Global Growth Equity Fund Tycoon Global Growth …