Fund Report July 2023 - Tycoon Global Growth Equity Fund

Tycoon Global Growth Fund Monthly Report - July 2023

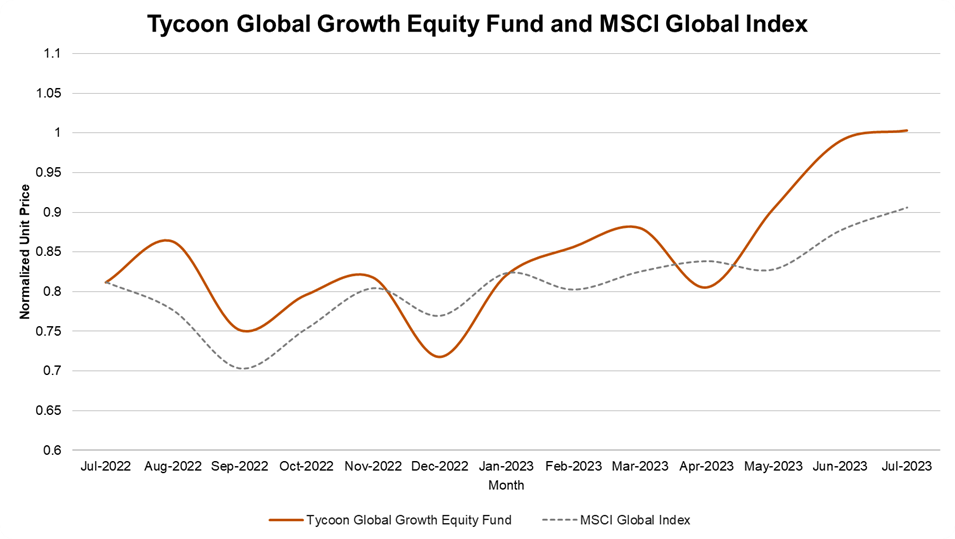

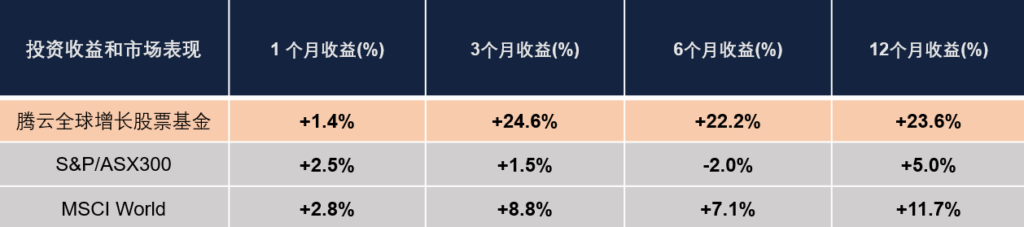

Fund Performance

In line with expectations, the Federal Reserve raised interest rates by 0.25% this month. However, robust employment market data and inflation indicators have instilled market confidence in a soft landing for the U.S. economy. Additionally, this month marks the earnings season for U.S. stocks, with investors closely monitoring companies’ specific revenue performance and the long-term impact of inflation on corporate profitability.

As of July 31, 2023, the Tycoon Global Growth Equity Fund has sustained its upward trend from June, achieving a monthly return of 1.4% and a one-year return of 23.6%. In comparison, the S&P/ASX 300 Index registered a one-year return of 5%, while the MSCI World Index posted a one-year return of 11.7%.

In July, global stock markets maintained a steady upward trend, with the U.S. Dow Jones Industrial Average achieving a record-breaking 13 consecutive trading days of gains, the longest winning streak since 1987. The market exhibited relative calmness this month, with a focus on interest rate and inflation data releases, as well as the minutes from the Federal Reserve’s policy meetings. Furthermore, economic data released this month indicated that despite rising borrowing costs, the U.S. economy is likely to achieve a soft landing and avoid recession. The U.S. Department of Commerce reported a year-on-year growth rate of 2.4% for the current quarter, significantly higher than the previous quarter’s 2.0% and the market’s expectation of approximately 1.8%. Both businesses and consumers continue to demonstrate positive sentiment.

Benefiting from the resurgence in the international travel market, leading online short-term rental platform Airbnb performed exceptionally well this month. The company has capitalized on the past year’s recovery in the tourism sector, and its annual revenue is projected to grow by more than 10%. Additionally, its extensive user base provides a stable source of income. Airbnb’s unique business model, offering personalized travel experiences, gives it an irreplaceable advantage in the competitive landscape.

In addition to the travel consumer market, AI-related stocks also exhibited positive momentum in July. The anticipated industrial upgrade brought about by artificial intelligence is gradually expanding into other market segments, such as the gaming sector. In collaboration with Microsoft, NVIDIA’s engineers introduced the Minecraft robot named “Voyager,” powered by GPT-4, which can automatically respond to players’ inquiries and requests and exhibit more than three times the task processing capacity of previous AI assistants. Furthermore, Voyager can be adapted into a software assistant to automate tasks through PC or mobile operating systems, showcasing the robust general capabilities of AI and its potential for rapid adoption across various industries.

Investment Philosophy

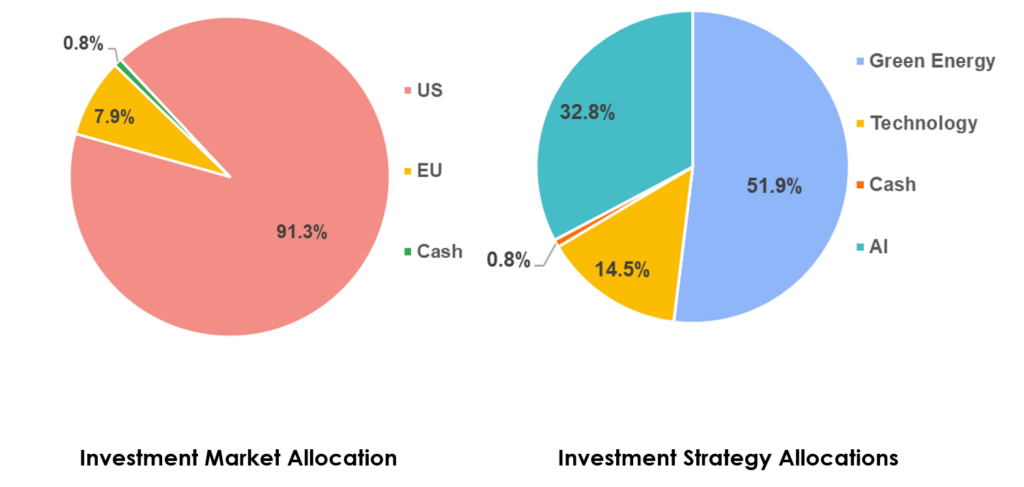

The Tycoon Global Growth Equity Fund is dedicated to identifying high-quality companies with a forward-looking perspective, firmly believing that these companies will attract capital appreciation due to their potential to drive human productivity. It aims to create long-term sustainable excess returns for investors. Additionally, the fund adopts a moderately diversified strategy, allocating investments in both the U.S. and European markets, with strategic emphasis on the green energy, technology, and artificial intelligence sectors. This approach ensures the fund’s stability and growth prospects.

Global Economic Trends

The current market’s central focus is on the rate of decline in inflation. In July, the U.S. Bureau of Economic Analysis released the Personal Consumption Expenditures Price Index (PCE) for June. The data revealed that the PCE, excluding food and energy, increased by only 0.2% compared to the previous month, in line with the estimates by Dow Jones. The core PCE grew by 4.1% from a year ago, which is slightly lower than the market estimate of 4.2%. This marks the lowest level since September 2021 and represents a decline from the 4.6% growth rate observed in May. The decrease in PCE indicates a further easing of U.S. inflation in June compared to May, which is viewed positively by the market as it may imply greater flexibility in the Federal Reserve’s future monetary policy decisions.

In addition to the Personal Consumption Expenditures Price Index, another key topic in the market is the possibility of a “soft landing” for the U.S. economy. “Soft landing” is an economic term that refers to policymakers adjusting policies to facilitate a smooth transition of the economy from an overheated state to a normal growth state without triggering an economic recession. This requires policymakers to have precise assessments of the economic conditions and accurate predictions of policy impacts.

As the Federal Reserve has reached the peak of interest rates and inflation is declining as expected, while employment indicators have not significantly worsened, more and more economists in the market believe that the Federal Reserve is likely to achieve a soft landing for the U.S. economy. This has significantly boosted market confidence.

Related Post:

Tycoon Global Growth Equity Fund Tycoon Global Growth Fund – Monthly Update 06 – 2024 Related Post: Tycoon Global Growth Equity Fund Tycoon Global Growth …

Tycoon Global Growth Equity Fund Tycoon Global Growth Fund – Monthly Update 05 – 2024 Related Post: Tycoon Global Growth Equity Fund Tycoon Global Growth …

Tycoon Global Growth Equity Fund Tycoon Global Growth Fund – Monthly Update 04 – 2024 Related Post: Tycoon Global Growth Equity Fund Tycoon Global Growth …

Tycoon Global Growth Equity Fund Tycoon Global Growth Fund – Monthly Update 03 – 2024 Related Post: Tycoon Global Growth Equity Fund Tycoon Global Growth …

Tycoon Global Growth Equity Fund Tycoon Global Growth Fund – Monthly Update 02 – 2024 Related Post: Tycoon Global Growth Equity Fund Tycoon Global Growth …

Tycoon Global Growth Equity Fund Tycoon Global Growth Fund – Monthly Update 01 – 2024 Related Post: Tycoon Global Growth Equity Fund Tycoon Global Growth …