Fund Report January 2023 - Tycoon Global Growth Equity Fund

Tycoon Global Growth Fund Monthly Report - January 2023

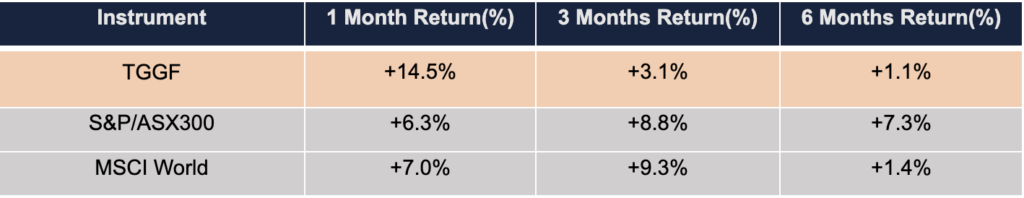

Fund Performance

Benefiting from Tesla’s better-than-expected earnings report, which led to a significant surge in stocks related to the electric vehicle industry, the Tycoon Global Growth Fund experienced a remarkable increase of 14.5% in January 2023, surpassing the overall market performance. As of January 31, 2023, the fund’s unit price stood at $0.82 per unit. The Tycoon Global Growth Fund has actively positioned itself in high-quality companies with long-term growth prospects, and we have confidence in the fund’s continued performance as global markets transition from bearish to bullish.

In the first month of 2023, global stock markets rebounded, with the MSCI World Index surging by 7.0% and the Nasdaq Technology Index experiencing a significant rebound of 10.7% following a steep decline at the end of the previous year. Economic data in January indicated that inflation was receding at a pace exceeding market expectations, signaling the potential end of the tightening cycle and encouraging continued inflow of funds into the stock market.

Macroeconomic Outlook

The core PCE price index, released by the U.S. Department of Commerce, increased by 4.4% in December compared to the same period last year. This marked a noticeable decrease from the 4.7% recorded in November and represented the smallest annual growth rate since October 2021. Additionally, personal consumption expenditures declined by 0.2% in December, indicating a cooling of the economy beyond market expectations. The Federal Reserve’s interest rate hikes have started to significantly suppress the demand side, contributing to the sustained decline in inflation in 2023. Combined with better-than-expected GDP data for the fourth quarter of 2022, this has fueled optimism on Wall Street that the tightening cycle may come to an end in the short term and that the economy can achieve a soft landing. This underlying logic has driven a significant rebound in the stock market since the start of the new year. After digesting the economic data for January, Wall Street believes that the current interest rate levels have effectively curbed inflation, and it is necessary for the Federal Reserve to timely shift its stance on interest rate hikes to avoid an economic recession and ultimately achieve the policy objective of a soft landing. The reopening of the Chinese economy has also boosted investor confidence in avoiding a global economic downturn, as businesses of related listed companies in the Chinese market gradually resume production and sales in the post-pandemic era. Considering the global trend of declining inflation, the gradual shift in monetary policy, the complete end of the pandemic worldwide, and the normalization of the industrial supply chain, it is undeniable that investors in 2023 will still face some uncertainties. However, some long-term capital has already entered the market, driving the market to slowly transition into a positive cycle where good news is good news and bad news is also good news. Overall, the confirmation of declining inflation and the impending end of the tightening cycle suggest that the global economy is expected to avoid a recession and move towards the best outcome of a soft landing.

Investment Strategy

Like the peak and retreat of inflation, other key factors that led the market into a bear market in 2022 are expected to turn around in 2023. For investors, 2023 is likely to be an exciting year, a year of policy shifts, a year of alternating bull and bear markets, and a rare year of harvest. From a long-term investment perspective, actively positioning in promising tracks and companies near the end of a bear market provides the strongest foundation for excess returns in the coming years.

As the rate hike cycle comes to an end, investors’ focus in 2023 shifts from interest rate hikes to corporate profitability and how companies can adjust their strategies and control costs in a challenging macro environment. The fittest will survive, and the companies that remain will shine brightly in the future, reaping the greatest rewards for investors who stay the course.

Top Five Investments(in alphabetical order)

- ALB US – Albemarle Corporation is a developer, manufacturer, and marketer of specialty chemicals. As of 2022, Albemarle has become the world’s largest lithium supplier for electric vehicle batteries.

- BRG AU – Breville Group Limited is the leading brand for kitchen small appliances in Australia and New Zealand. It is also a mainstream kitchen small appliance brand in the North American market, with coffee machines as its flagship products.

- LTHM US – Livent Corporation is a fully integrated lithium battery company. The company focuses on providing high-performance lithium compounds for the electric vehicle (EV) and broader battery markets. It currently has a market capitalization of $4.5 billion, a price-earnings ratio of 13.3, and an earnings per share of $1.6.

- TSLA US – Tesla, Inc. is a company involved in designing, developing, manufacturing, selling, and leasing electric vehicles, as well as energy production and storage systems. It also provides services related to its products. It currently has a market capitalization of $67.8 billion, a price-earnings ratio of 57, and an earnings per share of $4.0.

- WCH GY – Wacker Chemie AG is a globally operating specialty chemical materials company founded in 1914. As a pioneer in the field of modern chemistry, Wacker’s products include silicones, polymers, biotechnology, and polysilicon. It currently has a market capitalization of $6.6 billion, a price-earnings ratio of 6.3, and an earnings per share of $25.2.