Fund Report February 2023 - Tycoon Global Growth Equity Fund

01 Summary of this month's performance

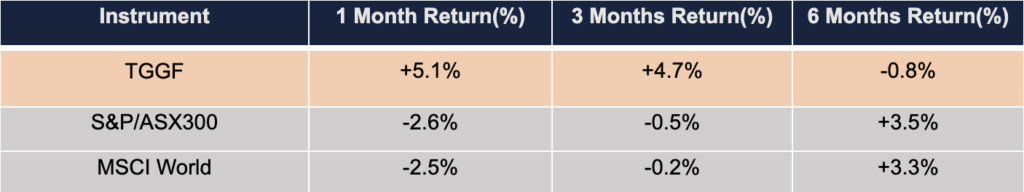

In February 2023, Tycoon Global Growth Fund bucked the trend and rose 5.1%, continuing the fund’s strong performance in January, with Tesla, NVIDIA, Wacker and other major positions all making positive contributions to the outstanding performance in February. We are confident in the fund’s continued performance as global markets emerge from the bear market due to our active placement of future-oriented, high-quality companies.

Global stocks corrected in February 2023 trading, with the MSCI World Index closing down 2.5% for the month and the Dow Jones Industrial Index down 4.2%. The Australian stock market was no exception, with the S&P/ASX300 index down 2.6%.

A string of strong economic data for February added to worries about a rebound in inflation and dampened investors’ optimism about the outlook for stocks. Minutes of the Federal Reserve’s meeting released mid-month also signaled the central bank’s continued determination to fight inflation by raising interest rates, leading Wall Street to wonder if the economy could smoothly achieve a soft landing. Economic uncertainty and the Fed’s ambiguity have sent stocks into a volatile correction after a sharp rally in January.

02 Fund investment strategy

Along with inflation’s peak and retreat, other key factors that sent markets into a bear market in 2022 are poised to turn the corner in 2023. For investors, 2023 is likely to be a wonderful year, a year of policy shift, a year of bull and bear altercountry, and a rare harvest year. From a long-term perspective, actively positioning long-term promising tracks and companies near the end of a bear market provides the strongest foundation for excess returns in the coming years.

As the rate hike cycle comes to an end, investors’ focus in 2023 has shifted from higher interest rates to corporate profitability and how companies can adjust corporate strategy and control costs in a difficult macro environment. The fittest survive, and the last companies will shine in the future, reaping the biggest rewards for the investors who stick it out last. We continue to look for future-oriented, high-quality companies that can be placed at reasonable prices and held for the long term to create sustainable high returns for investors as we grow with the company.

03 Macroeconomic Outlook

On the one hand, the economic resilience presented by the economic data is encouraging despite headwinds such as rising interest rates, cost of living crisis, Labour shortages and strikes. On the other hand, while various economic data suggest that the chances of a recession in the near term have fallen sharply, rising inflationary pressures clearly remain a concern, particularly in the services sector. The economy’s resilience and sticky inflation metrics raise the odds of further policy tightening by global central banks, which could dampen future growth expectations and raise the risk of the economy falling into a recession down the road. The most desirable scenario for markets is to quell inflation without further sharp interest rate hikes, so as to avoid excessive interest rates leading to mass layoffs and a deep recession, and thus achieve the best outcome of a soft landing to end the tightening cycle.

Recent Fed minutes showed policy makers’ determination to continue to fight inflation by raising interest rates, which Wall Street fears will eventually lead to a recession. Economic and policy uncertainty has left investors in a bind, causing markets to wobble and lack direction. This is a Fed that relies too much on data and lacks foresight. However, there are differences and contradictions between various data, coupled with the lag of data, which may lead to wrong decisions. So the soft landing the market is hoping for is difficult to achieve overnight, and the stock market is expected to continue to pull back and forth in this bad environment.

04 Top five investments - (in alphabetical order)

- IFX GY provides various semiconductor solutions, including microprocessors, LED drivers, sensors, automotive integrated circuits and power management chips.

- NVDA US Founded in January 1993, NVIDIA is a fabless semiconductor company specializing in the design and sale of graphics processors. The company is moving into the market for artificial intelligence and machine vision, and is the inventor of CUDA, an important development tool for graphics processors.

- LTHM US is a fully integrated lithium battery company. The company focuses on providing high-performance lithium compounds for the electric vehicle (EV) and broader battery markets.

- Tesla Inc. designs, develops, manufactures, sells, and leases electric vehicles and energy production and storage systems, and provides services related to its products.

- Founded in 1914, WCH GY is a global specialty chemical materials company. As a pioneer in modern chemistry, WACKER’s products include silicones, polymers, biotechnology and polysilicon.