Fund Report March 2023 - Tycoon Global Growth Equity Fund

01 Summary of this month's performance

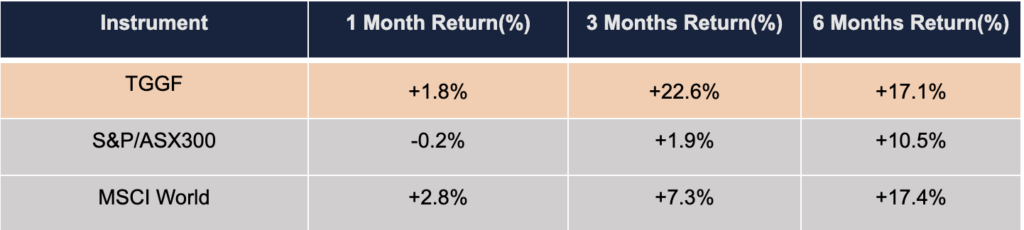

The Tycoon Global Growth Fund gained 1.8% in March 2023, marking a third straight month of positive returns, with major positions such as NVIDIA, Infineon and Salesforce all contributing positively to the March performance. We are confident in the fund’s continued performance as global markets emerge from the bear market due to our active placement of future-oriented, high-quality companies.

Global stocks were mixed in March 2023 trading, with the MSCI World Index ending the month up 2.8%, the Dow Jones Industrial Index up 1.9% and Australia’s S&P/ASX300 down 0.2%. In March, European and US markets experienced a panic triggered by the banking crisis, but it was temporarily contained by the quick and forceful intervention of governments and regulators. Silicon Valley Bank, the 16th largest in the United States, collapsed under the double blow of losses on its bond portfolio and a liquidity crisis, and was eventually taken over by regulators, preventing further contagion within the banking system. Silicon Valley Bank’s failure is the biggest bank failure since the global financial crisis, a casualty of the Fed’s successive aggressive interest rate hikes over the past 12 months. At the same time, the successful forced takeover of the troubled Credit Suisse by UBS, orchestrated and facilitated by the Swiss government, calmed market sentiment after a brief period of panic. Although policymakers and central bankers continue to reassure markets that the banking system is not headed for a collapse, investors remain concerned about the aftereffects of the banking crisis, especially the credit crunch caused by the banking crisis, which may be a hot topic to watch in the future.

02 Fund investment strategy

In March, the Fed raised its benchmark rate by another quarter-point for the ninth time since the cycle began in March 2022, taking it to a range between 4.75% and 5%. While Wall Street has blamed the recent banking crisis on the central bank raising interest rates too aggressively, the Fed is not thinking about cutting rates any time soon. Fed Chairman Jerome Powell has acknowledged that the banking crisis could lead to a credit crunch that could hit an already fragile economy, but the Fed is sticking to its goal of trying to get inflation down to 2%. Still, the banking crisis at least gave the Fed pause for its reckless stance on rate increases, prompting an early end to the cycle.

Several recent economic data point to signs that the overheating economy is cooling, and in particular, the resilient labor market is starting to loosen, suggesting that the Fed’s anti-inflation efforts are having an effect. But until the Fed fully shifts to an expansionary monetary normalcy, markets will be choppy and without a clear trend. While investors are optimistic that a cooling economy could push the Federal Reserve to end its cycle of tightening monetary policy, Wall Street is starting to worry that too much cooling could lead to a deeper recession. More important, markets remain sceptical that the Fed can shift its stance on rate rises in time to avoid a slide into recession. The Fed continues to be ambiguous between balancing interest rate hikes and interest rate cuts, hard landing and soft landing, resulting in a volatile macroeconomic environment for markets.

03 Macroeconomic Outlook

Along with inflation’s peak and retreat, other key factors that sent markets into a bear market in 2022 are poised to turn the corner in 2023. For investors, 2023 is likely to be a wonderful year, a year of policy shift, a year of bull and bear altercountry, and a rare harvest year. From a long-term perspective, actively positioning long-term promising tracks and companies near the end of a bear market provides the strongest foundation for excess returns in the coming years.

As the rate hike cycle comes to an end, investors’ focus in 2023 has shifted from higher interest rates to corporate profitability and how companies can adjust corporate strategy and control costs in a difficult macro environment. The fittest survive, and the last companies will shine in the future, reaping the biggest rewards for the investors who stick it out last. We continue to look for future-oriented, high-quality companies that can be placed at reasonable prices and held for the long term to create sustainable high returns for investors as we grow with the company.

04 Top five investments - (in alphabetical order)

- IFX GY provides various semiconductor solutions, including microprocessors, LED drivers, sensors, automotive integrated circuits and power management chips.

- LTHM US is a fully integrated lithium battery company. The company focuses on providing high-performance lithium compounds for the electric vehicle (EV) and broader battery markets.

- NVDA US Founded in January 1993, NVIDIA is a fabless semiconductor company specializing in the design and sale of graphics processors. The company is moving into the market for artificial intelligence and machine vision, and is the inventor of CUDA, an important development tool for graphics processors.

- Tesla Inc. designs, develops, manufactures, sells, and leases electric vehicles and energy production and storage systems, and provides services related to its products.

- Founded in 1914, WCH GY is a global specialty chemical materials company. As a pioneer in modern chemistry, WACKER’s products include silicones, polymers, biotechnology and polysilicon.